Is Buying A Computer For Work Tax Deductible . Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web in this article, we’ll take you through the steps involved in claiming a laptop on your tax return, starting with the most obvious question. Web you can claim a deduction for a device you buy and use for work, such as a:

from opendocs.com

Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web in this article, we’ll take you through the steps involved in claiming a laptop on your tax return, starting with the most obvious question. Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Web you can claim a deduction for a device you buy and use for work, such as a:

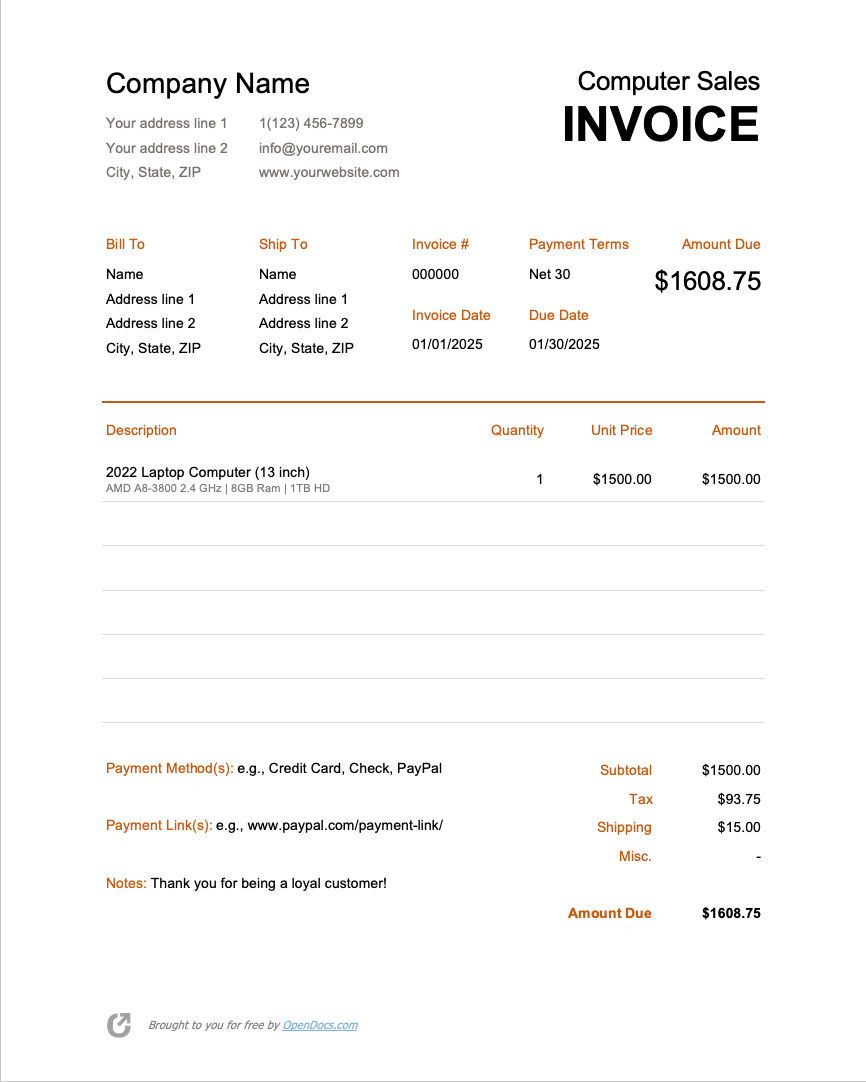

Free Computer Sales Invoice Template PDF WORD EXCEL

Is Buying A Computer For Work Tax Deductible Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Web you can claim a deduction for a device you buy and use for work, such as a: Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web in this article, we’ll take you through the steps involved in claiming a laptop on your tax return, starting with the most obvious question. Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of.

From opendocs.com

Free Computer Sales Invoice Template PDF WORD EXCEL Is Buying A Computer For Work Tax Deductible Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Web you can claim a deduction for a device you buy and use for work, such as a: Web in this article, we’ll take you through the steps involved in claiming a laptop on your tax return, starting with. Is Buying A Computer For Work Tax Deductible.

From www.galwayit.ie

Tips for buying Business Computers Galway IT solutions Is Buying A Computer For Work Tax Deductible Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web you can claim a deduction for a device you buy and use for work, such as a: Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web if you're. Is Buying A Computer For Work Tax Deductible.

From bleuwire.com

Buying a Used Computer? Check These Things Before Buying Is Buying A Computer For Work Tax Deductible Web you can claim a deduction for a device you buy and use for work, such as a: Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Web if you're employed and required to work from home and have recently bought a personal computer, you may be able. Is Buying A Computer For Work Tax Deductible.

From smithpatrickcpa.com

Is the Cost of Your Home Computer Tax Deductible? Smith Patrick CPAs Is Buying A Computer For Work Tax Deductible Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have. Is Buying A Computer For Work Tax Deductible.

From www.leanonmeit.com

Buying a PC for business? This is what you need to know. Is Buying A Computer For Work Tax Deductible Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of.. Is Buying A Computer For Work Tax Deductible.

From cgscomputer.com

Buying Refurbished Computers For Your Business Is It Too Risky Is Buying A Computer For Work Tax Deductible Web in this article, we’ll take you through the steps involved in claiming a laptop on your tax return, starting with the most obvious question. Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web if you're employed and required to work from home and have recently bought a personal computer, you may be able. Is Buying A Computer For Work Tax Deductible.

From www.pinterest.com.au

The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business Is Buying A Computer For Work Tax Deductible Web in this article, we’ll take you through the steps involved in claiming a laptop on your tax return, starting with the most obvious question. Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web if you're employed and required to work from home. Is Buying A Computer For Work Tax Deductible.

From communitycomputerservices.com

10 Things to Think About When Buying a Used Computer Is Buying A Computer For Work Tax Deductible Web you can claim a deduction for a device you buy and use for work, such as a: Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web in most cases you can claim tax relief on the full cost of substantial equipment, for example. Is Buying A Computer For Work Tax Deductible.

From www.pinterest.co.uk

Common Deductible Business Expenses Business expense, Bookkeeping Is Buying A Computer For Work Tax Deductible Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Web. Is Buying A Computer For Work Tax Deductible.

From www.techsagar.com

Build vs Buying a PC What You Should Know Beforehand [Updated 2021] Is Buying A Computer For Work Tax Deductible Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web in this article, we’ll take you through the steps involved in claiming a laptop on your tax return, starting with the most obvious question. Web you can claim a deduction for a device you buy and use for work, such as a: Web if you're. Is Buying A Computer For Work Tax Deductible.

From www.sage.com

Taxdeductible expenses for small businesses Sage Advice South Africa Is Buying A Computer For Work Tax Deductible Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web you can claim a deduction for a device you buy and use for work, such as a: Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web know the types. Is Buying A Computer For Work Tax Deductible.

From topaccountants.com.au

Tax Deduction for Computer or Laptop? Is Buying A Computer For Work Tax Deductible Web in this article, we’ll take you through the steps involved in claiming a laptop on your tax return, starting with the most obvious question. Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web in most cases you can claim tax relief on the. Is Buying A Computer For Work Tax Deductible.

From www.easytechjunkie.com

How do I Choose the Best Laptop Processor? (with pictures) Is Buying A Computer For Work Tax Deductible Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Employment expenses are expenses that are 'wholly and exclusively' incurred in. Is Buying A Computer For Work Tax Deductible.

From thefinance.sg

A Singaporean’s Guide How to Claim Tax Deduction for Work Is Buying A Computer For Work Tax Deductible Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web you can claim a deduction for a device you buy and use for work, such as a: Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web know the. Is Buying A Computer For Work Tax Deductible.

From queryok.com

Things You Need to Keep in Mind Before Buying a Computer Query OK Is Buying A Computer For Work Tax Deductible Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Web in most cases you can claim tax relief on the full cost of substantial. Is Buying A Computer For Work Tax Deductible.

From www.ba-bamail.com

Tips to Consider When Buying a Computer Is Buying A Computer For Work Tax Deductible Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Employment expenses are expenses that are 'wholly and exclusively' incurred in. Is Buying A Computer For Work Tax Deductible.

From agingnext.org

Is Volunteer Work Tax Deductible? Agingnext Is Buying A Computer For Work Tax Deductible Web in most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to. Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of.. Is Buying A Computer For Work Tax Deductible.

From www.pinterest.com

TaxDeductible Home Improvements What You Should Know This Year Tax Is Buying A Computer For Work Tax Deductible Web know the types of business expenses that are tax deductible to reduce your company's taxable income, and which are non. Web if you're employed and required to work from home and have recently bought a personal computer, you may be able to claim the. Employment expenses are expenses that are 'wholly and exclusively' incurred in the production of. Web. Is Buying A Computer For Work Tax Deductible.